-

Categories

-

Pharmaceutical Intermediates

-

Active Pharmaceutical Ingredients

-

Food Additives

- Industrial Coatings

- Agrochemicals

- Dyes and Pigments

- Surfactant

- Flavors and Fragrances

- Chemical Reagents

- Catalyst and Auxiliary

- Natural Products

- Inorganic Chemistry

-

Organic Chemistry

-

Biochemical Engineering

- Analytical Chemistry

-

Cosmetic Ingredient

- Water Treatment Chemical

-

Pharmaceutical Intermediates

Promotion

ECHEMI Mall

Wholesale

Weekly Price

Exhibition

News

-

Trade Service

Asia's major petrochemicals markets tracked post-holiday gains in China to further strengthen on the back of strong gains in upstream crude futures

.

Oil prices hit multi-year highs on Monday, with U.

S.

WTI and Brent both up at least 3 percent last week, in signs that demand will recover further from the pandemic

.

Amid global shortages, natural gas and coal prices have soared, forcing consumers to switch to fuel oil and diesel

.

Petrochemical prices in China surged after a one-week break on tighter supply conditions and strong crude prices

.

Asian spot ethylene prices rose to about 30-week highs last week amid strong Chinese buying amid logistical bottlenecks and high feedstock costs

.

Spot supplies may not be able to meet Chinese demand for cargo arriving in November, as vessel strain exceeds the normal offshore healthy supply from Northeast and Southeast Asian producers

.

China's domestic ethylene prices have soared, helped by post-holiday inventory replenishment and cuts in methanol supplies

.

After the week-long National Day holiday, some ethylene buyers boosted production as local governments eased restrictions on energy consumption in some areas

.

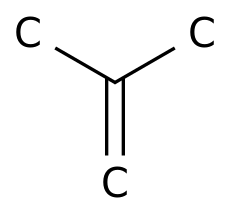

Spot prices in Northeast Asia surged early last week on strong downstream PP futures in China, but were moderated by expectations that supply in China's domestic market could be extended in the fourth quarter

.

Spot liquidity was limited as most market participants took a wait-and-see approach

.

In the Southeast Asian PP market, discussions tracked a strong rally in China early last week, but as the week progressed, the PP futures market lost dynamism and discussions slowed

.

In the styrene monomer (SM) market, prices at the beginning of last week broke through the psychological barrier of $1,300/t cfr China for the first time since May 2021

.

But the rally was followed by a profit-taking sell-off in the middle of the week

.

Market supply and demand fundamentals are mixed, and this is likely to continue into much of the fourth quarter

.