-

Weighed down by weak demand, Shanghai copper's rally was limited

Time of Update: 2023-02-02

Fundamentally, global copper inventories are at historic lows, domestic refined copper production is less than expected, spot supply is still tight, and the rising water rebounds to a high level, providing short-term support for prices.

-

December 27 Lun aluminum noon review

Time of Update: 2023-02-02

Oil prices stock market continued to strengthen, market risk appetite warmed up, Shanghai aluminum opened high in the evening, closed strongly at the end of the day, the latest opening price of the main month 2302 contract was 18725 yuan / ton, up 160 yuan, or 0.

-

Rubber raw material prices are mixed, and it is expected that the downside is limited

Time of Update: 2023-02-02

RU non-standard price difference of 1945 yuan / ton (+100), tobacco chip import profit 23 yuan / ton (+43).

RU non-standard price difference of 1945 yuan / ton (+100), tobacco chip import profit 23 yuan / ton (+43).

-

Rubber is strong and oscillating is expected to increase the expectation of returning to work

Time of Update: 2023-02-02

The rainfall in the main producing countries of Thailand and Vietnam has decreased, the rubber tapping season is expected to increase the supply of raw materials, the price of glue continues to fall, the expectation of returning to work is strengthened, and the recovery of domestic economic activities in the later period is expected to bring about a stable rebound of far month contracts.

-

December 2022 cable raw materials (copper) monthly report

Time of Update: 2023-02-02

On the macro front, the Fed's interest rate hike landed, 50 basis points in line with market expectations, and the upper limit of interest rates was raised this round, but due to the slowing trend, the dollar continued to decline this month, but the decline also slowed down, and the impact on copper prices weakened.

-

Shanghai copper opens low and goes low, and the center of gravity has shifted slightly down

Time of Update: 2023-02-02

9 percentage points year-on-year, and it is expected that the operating rate of wire and cable enterprises in January 2023 will decline again month-on-month; the actual demand for terminals is significantly weaker, the nonferrous market sentiment is cautious, and the weak reality is difficult to change in the short term, and the accumulation of internal and external inventories, the support margin of inventory to the price weakens, and copper or falls.

-

Narrowing of the current price spread is expected to have limited room for rubber to fall

Time of Update: 2023-02-02

Domestic raw materials: Yunnan glue 10800 yuan / ton (0), Hainan glue 11350 yuan / ton (0).

Domestic raw materials: Yunnan glue 10800 yuan / ton (0), Hainan glue 11350 yuan / ton (0).

-

Spot premiums fell at high levels limiting copper price gains

Time of Update: 2023-02-02

Overall, the macro atmosphere is warm, boosting the rise of non-ferrous metals across the board, but the copper market has a state of weak supply and demand, and the spot premium has fallen at a high level, which has involved the rise in copper prices.

-

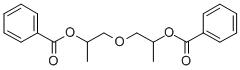

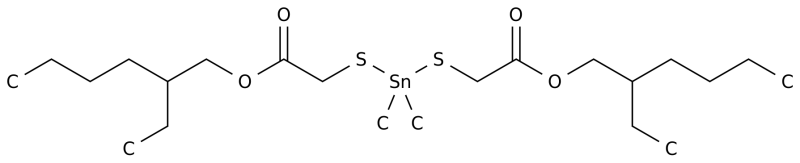

PVC volatility weak operation Fundamentals are not expected well

Time of Update: 2023-02-02

20, the main PVC closed at 6275 yuan / ton (+0.

20, the main PVC closed at 6275 yuan / ton (+0.

20, the main PVC closed at 6275 yuan / ton (+0.

20, the main PVC closed at 6275 yuan / ton (+0.

-

Shanghai rubber continuous pullback is expected to maintain a biased space situation in the short term

Time of Update: 2023-02-02

Shanghai rubberRecently, the operating rate of domestic tire companies has continued to decline year-on-year, and the inventory of finished products is high, and the New Year's Day and Spring Festival are approaching, and the operating rate of enterprises will remain at a low level in the next two months.