-

Categories

-

Pharmaceutical Intermediates

-

Active Pharmaceutical Ingredients

-

Food Additives

- Industrial Coatings

- Agrochemicals

- Dyes and Pigments

- Surfactant

- Flavors and Fragrances

- Chemical Reagents

- Catalyst and Auxiliary

- Natural Products

- Inorganic Chemistry

-

Organic Chemistry

-

Biochemical Engineering

- Analytical Chemistry

-

Cosmetic Ingredient

- Water Treatment Chemical

-

Pharmaceutical Intermediates

Promotion

ECHEMI Mall

Wholesale

Weekly Price

Exhibition

News

-

Trade Service

1.

Analysis of industrial chain of bisphenol A industry

Analysis of industrial chain of bisphenol A industry

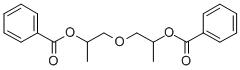

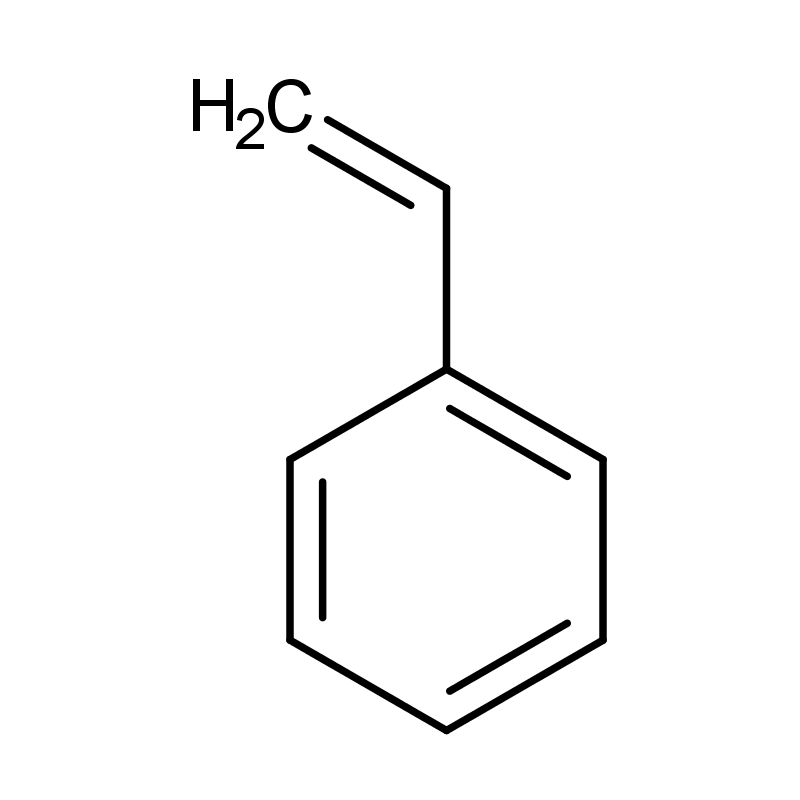

Compared with other chemical products, the bisphenol A industry has more obvious characteristics of industrial chain integration

.

On the other hand, it is mainly used in the production of epoxy resin and polycarbonate, and can also be used in the production of various polymer materials such as polysulfone resin and unsaturated resin, as well as related products in the fields of pesticides and medicine

.

2.

The supply and demand of China's bisphenol A market are rising

The supply and demand of China's bisphenol A market are rising

From 2014 to 2019, the output of bisphenol A in China showed an overall growth trend year by year.

In 2019, the output of bisphenol A in China was about 1.

355 million tons, an increase of 155,000 tons compared with 1.

2 million tons in 2018, an increase of 11.

44% year-on-year, and the output growth rate was significant.

Due to the rapid expansion of production capacity, although the capacity utilization rate has declined, it is still at a high level of utilization

.

From the perspective of demand, with the growth of terminal demand, the consumption of bisphenol A in China has also maintained a growth trend

.

The PC industry is in a period of rapid development, and future production capacity will continue to be released

.

3.

Imports make up for the gap in domestic bisphenol A market demand

Imports make up for the gap in domestic bisphenol A market demand

It can be seen from the above analysis that although the output of China's bisphenol A market is increasing year by year, due to the low commercialization rate, the industry market demand still needs to be met by imports

.

From the export point of view, China's bisphenol A exports have remained at a relatively low level over the years, and the export volume is less than 10,000 tons.

Although the export volume in 2019 increased rapidly, it was only 9,900 tons, which is relatively higher than the import volume.

big gap

.

4.

The PC industry has a greater demand for bisphenol A

The PC industry has a greater demand for bisphenol A

In China, the downstream consumption of bisphenol A is relatively single, and the largest downstream consumption is the epoxy resin and PC industries, which together account for more than 90%

.

Since 2014, the demand for bisphenol A in China's epoxy resin industry has grown slowly, and the proportion of downstream consumption of bisphenol A has gradually decreased from 70% in 2014 to 44% in 2019

.

On the other hand, the production of another downstream PC has maintained an upward trend under the development of the terminal industry and favorable policies.

In addition, the PC has a high unit consumption of bisphenol A, and the demand for bisphenol A has gradually increased

.

From the perspective of the proportion of downstream consumption, the proportion of polycarbonate consumption increased from 26% in 2014 to 53% in 2019

.

5.

Forecast of development prospects of China's bisphenol A industry

Forecast of development prospects of China's bisphenol A industry

In November 2019, the National Development and Reform Commission issued the "Industrial Structure Adjustment Guidance Catalog (2019 Edition)"

.

The "Catalogue (2019 Edition)" involves a total of 48 industries and 1,477 items, including 821 encouraged, 215 restricted, and 441 eliminated

.

"100,000 tons/year and above ion-exchange bisphenol A" is still in the encouraged petrochemical chemical project

.

In the next five years, the production capacity of bisphenol A projects under construction and proposed in China will reach nearly 4 million tons.

From the perspective of project planning and construction cycle, it is expected that the concentrated release of production capacity will be in 2021-2022

.

Among them, the planned production capacity of independent units is very small, and most of them are upstream and downstream facilities, mainly supporting phenol acetone and PC units

.

In 2020, China's bisphenol A and major upstream and downstream industries have plans to add new production capacity

.

Judging from the data, the newly added capacity of bisphenol A as an intermediate product is relatively limited, while the upstream phenol acetone and downstream PC industries have expanded more capacity

.

At the same time, with the addition of large refining and chemical integrated enterprises, the cost competition in the industry has become more and more obvious

.