-

Categories

-

Pharmaceutical Intermediates

-

Active Pharmaceutical Ingredients

-

Food Additives

- Industrial Coatings

- Agrochemicals

- Dyes and Pigments

- Surfactant

- Flavors and Fragrances

- Chemical Reagents

- Catalyst and Auxiliary

- Natural Products

- Inorganic Chemistry

-

Organic Chemistry

-

Biochemical Engineering

- Analytical Chemistry

-

Cosmetic Ingredient

- Water Treatment Chemical

-

Pharmaceutical Intermediates

Promotion

ECHEMI Mall

Wholesale

Weekly Price

Exhibition

News

-

Trade Service

Recently, the anti-epileptic drug market has been reported frequently, Northeast Pharmaceutical's levetiracetam concentrated solution for injection has been approved, and Guangzhou Poinsettia Pharmaceutical's oxcarbazepine oral suspension has been accepted

by CDE.

According to data from Minai.

com, the sales of terminal antiepileptic drugs in China's public medical institutions in the first half of 2022 increased by 9.

11%

year-on-year.

Among the TOP10, the growth rate of 3 products doubled, and 9 brands sold more than 100 million

.

Up to now, 27 varieties (134 acceptance numbers) of antiepileptic drugs have been submitted for production, of which 9 have not been approved in China, involving Shijiazhuang Four Medicines, Jiangsu Coastal Pharmaceutical| Yangtze River Pharmaceutical Group Jiangsu Pharmaceutical and many other enterprises

.

In addition, there are 4 new antiepileptic class 1 drugs under development

.

by CDE.

According to data from Minai.

com, the sales of terminal antiepileptic drugs in China's public medical institutions in the first half of 2022 increased by 9.

11%

year-on-year.

Among the TOP10, the growth rate of 3 products doubled, and 9 brands sold more than 100 million

.

Up to now, 27 varieties (134 acceptance numbers) of antiepileptic drugs have been submitted for production, of which 9 have not been approved in China, involving Shijiazhuang Four Medicines, Jiangsu Coastal Pharmaceutical| Yangtze River Pharmaceutical Group Jiangsu Pharmaceutical and many other enterprises

.

In addition, there are 4 new antiepileptic class 1 drugs under development

.

Anti-epileptic drugs have been approved one after another, and Northeast Pharmaceutical has increased its size by 1 billion varieties

A few days ago, Northeast Pharmaceutical issued an announcement that Shenyang First Pharmaceutical, a wholly-owned subsidiary of the company, was approved for generic production of levetiracetam concentrated solution for injection in class 4, which is regarded as a review, as early as January this year, its levetiracetam tablets were also approved

for generic type 4 production.

Northeast Pharmaceutical said that the approval of levetiracetam concentrated solution for injection will further enrich the company's product pipeline in the field of anti-epilepsy, which is conducive to enhancing market competitiveness, and its listing and sales will have a positive impact

on the company's performance.

for generic type 4 production.

Northeast Pharmaceutical said that the approval of levetiracetam concentrated solution for injection will further enrich the company's product pipeline in the field of anti-epilepsy, which is conducive to enhancing market competitiveness, and its listing and sales will have a positive impact

on the company's performance.

Sales of levetiracetam in recent years (: billion yuan)

Source: Minai.

com Competition Pattern of Drug Terminals in China's Public Medical Institutions

com Competition Pattern of Drug Terminals in China's Public Medical Institutions

The original research company of levetiracetam concentrated solution for injection is Uniratio Pharmaceutical, which is used for the treatment

of partial seizures (with or without secondary generalized seizures) in adults and children over 4 years old.

According to data from Minai.

com, in recent years, the market size of levetiracetam in China's urban public hospitals, county-level public hospitals, urban community centers and township health centers (referred to as China's public medical institutions) has exceeded 1 billion yuan, with a year-on-year increase of nearly 20% in the first half of 2022, which is a generic name TOP2 variety, and the dosage forms of levetiracetam have been marketed in tablets, oral liquids and injections

.

of partial seizures (with or without secondary generalized seizures) in adults and children over 4 years old.

According to data from Minai.

com, in recent years, the market size of levetiracetam in China's urban public hospitals, county-level public hospitals, urban community centers and township health centers (referred to as China's public medical institutions) has exceeded 1 billion yuan, with a year-on-year increase of nearly 20% in the first half of 2022, which is a generic name TOP2 variety, and the dosage forms of levetiracetam have been marketed in tablets, oral liquids and injections

.

Anti-epileptic drugs approved this year

Source: Minai.

com China Declaration Progress (MED) database

com China Declaration Progress (MED) database

Since the beginning of this year, 11 antiepileptic drugs (44 acceptance numbers) have been approved, with sodium valproate concentrated solution for injection and levetiracetam concentrated solution for injection being the most popular, and the number of approved enterprises is 6 and 5 respectively; Three products were born for the first time, namely clobazam tablets from Yichang Renfu Pharmaceutical, levetiracetam sodium chloride injection from Hebei Renhe Yikang Pharmaceutical, carbamazepine sustained-release tablets (II.

)

from Qingdao BAHEAL Pharmaceutical | Shanghai Ambisen Pharmaceutical.

)

from Qingdao BAHEAL Pharmaceutical | Shanghai Ambisen Pharmaceutical.

TOP10 is out! The growth rate of 3 products doubled, and 9 major brands sold more than 100 million

According to data from Minai.

com, in recent years, the sales scale of antiepileptic drugs in China's three major terminal markets (see the end of this article for statistical scope) has increased year by year, and it has approached 7 billion yuan

in 2021.

Among them, the terminal of public medical institutions in China is the main battlefield, accounting for more than 80% of the market share, with a year-on-year increase of 9.

11%

in the first half of 2022.

com, in recent years, the sales scale of antiepileptic drugs in China's three major terminal markets (see the end of this article for statistical scope) has increased year by year, and it has approached 7 billion yuan

in 2021.

Among them, the terminal of public medical institutions in China is the main battlefield, accounting for more than 80% of the market share, with a year-on-year increase of 9.

11%

in the first half of 2022.

Top 10 antiepileptic drug products in the first half of 2022 (: 100 million yuan)

Source: Minai.

com Competition Pattern of Drug Terminals in China's Public Medical Institutions

com Competition Pattern of Drug Terminals in China's Public Medical Institutions

Note: Sales of less than 100 million yuan are indicated by *

Among the top 10 products, 8 have sales of more than 100 million yuan, and the sales scale of sodium valproate for injection has exceeded 1 billion yuan in recent years, with a slight decline

in the first half of this year.

Levetiracetam concentrated solution for injection, carbamazepine tablets, and lacosamide tablets all increased by more than 100% year-on-year, among which, lacosamide tablets entered the top ten

for the first time.

in the first half of this year.

Levetiracetam concentrated solution for injection, carbamazepine tablets, and lacosamide tablets all increased by more than 100% year-on-year, among which, lacosamide tablets entered the top ten

for the first time.

Top 10 anti-epileptic drug brands in the first half of 2022 (: 100 million yuan)

Source: Minai.

com Competition Pattern of Drug Terminals in China's Public Medical Institutions

com Competition Pattern of Drug Terminals in China's Public Medical Institutions

Note: Sales of less than 1 million yuan are indicated by *

Among the top 10 brands, foreign brands and domestic brands each account for half of the country, with 9 sales exceeding 100 million yuan

.

From the perspective of growth rate, 5 domestic brands are all positive growth, among which, Zhejiang Prokangyu Pharmaceutical's levetiracetam tablets have the fastest growth rate, more than 30%; Only 1 foreign brand has positive growth

.

.

From the perspective of growth rate, 5 domestic brands are all positive growth, among which, Zhejiang Prokangyu Pharmaceutical's levetiracetam tablets have the fastest growth rate, more than 30%; Only 1 foreign brand has positive growth

.

Antiepileptic drug over-evaluation

Source: Minai.

com China Declaration Progress (MED) database

com China Declaration Progress (MED) database

According to data from Minai.

com, 20 products (129 specifications) of antiepileptic drugs have been evaluated, and levetiracetam concentrated solution for injection and levetiracetam tablets are hot products, and more than 10 companies have been evaluated

.

Huahai Pharmaceutical led the way with 5 product reviews, namely levetiracetam concentrated solution for injection, topiramate tablets, levetiracetam sustained-release tablets, lamotrigine tablets, and levetiracetam tablets

.

com, 20 products (129 specifications) of antiepileptic drugs have been evaluated, and levetiracetam concentrated solution for injection and levetiracetam tablets are hot products, and more than 10 companies have been evaluated

.

Huahai Pharmaceutical led the way with 5 product reviews, namely levetiracetam concentrated solution for injection, topiramate tablets, levetiracetam sustained-release tablets, lamotrigine tablets, and levetiracetam tablets

.

In the first seven batches of collection, 5 antiepileptic drugs have been included: levetiracetam tablets (the first batch), levetiracetam concentrated solution for injection (the third batch), levetiracetam oral solution (the third batch), gabapentin capsules (the fourth batch), and lacosamide tablets (the seventh batch), among which the market share of levetiracetam tablets, levetiracetam oral solution and gabapentin capsules has declined

.

Lacosamide tablets are the seventh batch of centralized procurement varieties, and what changes will occur in the market in the future, Minai.

com will continue to pay attention

.

.

Lacosamide tablets are the seventh batch of centralized procurement varieties, and what changes will occur in the market in the future, Minai.

com will continue to pay attention

.

Yangtze River, Shi Four Medicines.

.

.

Sprint the first imitation, Jingxin, Enhua 4 new class 1 new drugs are coming

.

.

Sprint the first imitation, Jingxin, Enhua 4 new class 1 new drugs are coming

There are currently no antiepileptic drugs approved for generic drugs in China and are under review

Source: Minai.

com China Declaration Progress (MED) database

com China Declaration Progress (MED) database

Recently, Guangzhou Poinsettia Pharmaceutical was accepted by CDE for the generic production of Oxcarbazepine oral suspension of Class 4, which is suitable for adults and children over 2 years old to treat primary generalized tonic-clonic seizures and partial seizures, with or without secondary generalized seizures

.

According to data from Minai.

com, the terminal sales of oxcarbazepine in China's public medical institutions exceed 600 million yuan, and the marketed preparations include oxcarbazepine tablets and oxcarbazepine oral suspension, of which oxcarbazepine oral suspension only Novartis has production approval

.

.

According to data from Minai.

com, the terminal sales of oxcarbazepine in China's public medical institutions exceed 600 million yuan, and the marketed preparations include oxcarbazepine tablets and oxcarbazepine oral suspension, of which oxcarbazepine oral suspension only Novartis has production approval

.

Up to now, 27 varieties (134 acceptance numbers) of antiepileptic drugs have been submitted for production, of which 9 varieties such as stipentanol dry suspension, lacosamide syrup, perampanel tablets have not been approved in China, involving Shijiazhuang Four Medicines, Jiangsu Coastal Pharmaceutical| Yangtze River Pharmaceutical Group Jiangsu Pharmaceutical, Jiangsu Kangyuan Pharmaceutical and many other enterprises

.

.

The status of anti-epileptic class 1 new drugs under development

Source: Minai.

com China Declaration Progress (MED) database

com China Declaration Progress (MED) database

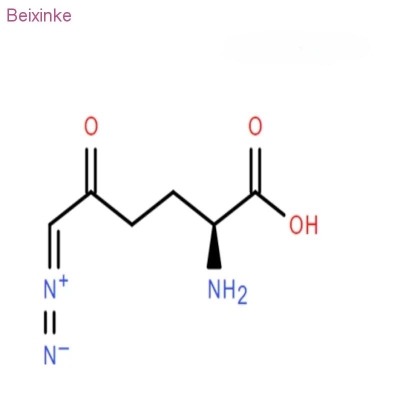

In addition, there are 4 (8 acceptance numbers) antiepileptic class 1 new drugs under development, namely WX0005 tablets, TPN102 tablets, DP-VPA tablets, and JBPOS0101 capsules

.

.

JBPOS0101 capsule reduces neuronal firing by binding to metabolic glutamate receptors, which belongs to First-in-Class (the world's first), and there is currently no homogeneous target drug on the market

worldwide.

In September this year, Jingxin Pharmaceutical issued an announcement that JBPOS0101 capsules were approved for clinical use for adult focal epilepsy

.

It is understood that in August 2021, Jingxin Pharmaceutical reached a cooperation with South Korea's B-PS company to introduce the JBPOS0101 project with a down payment of 5 million US dollars, a milestone payment of up to 35 million US dollars and a royalty transaction based on the total sales of the product, and the company has invested about 40 million yuan

in this project.

worldwide.

In September this year, Jingxin Pharmaceutical issued an announcement that JBPOS0101 capsules were approved for clinical use for adult focal epilepsy

.

It is understood that in August 2021, Jingxin Pharmaceutical reached a cooperation with South Korea's B-PS company to introduce the JBPOS0101 project with a down payment of 5 million US dollars, a milestone payment of up to 35 million US dollars and a royalty transaction based on the total sales of the product, and the company has invested about 40 million yuan

in this project.

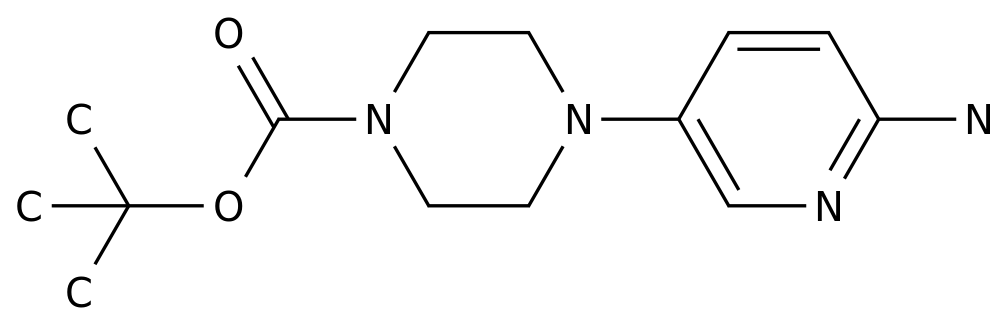

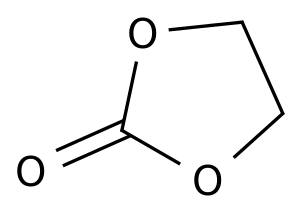

DP-VPA tablets are Class 1 new drugs introduced by Enhua Pharmaceutical from abroad, and are a new anti-epileptic drug

based on VPA (valproic acid) improvement.

The data show that DP-VPA has better safety and pharmacokinetic properties

than valproic acid.

Currently, the clinical phase I of this product has been completed

.

based on VPA (valproic acid) improvement.

The data show that DP-VPA has better safety and pharmacokinetic properties

than valproic acid.

Currently, the clinical phase I of this product has been completed

.

Source: Minainet database, company announcements

Note: The statistical scope of "China's Three Major Terminals and 6 Major Markets Competition Pattern" by Minai.

com is: urban public hospitals and county-level public hospitals, urban community centers and township health centers, urban physical pharmacies and online pharmacies, excluding private hospitals, private clinics, village clinics, excluding county and rural pharmacies; The above sales are calculated

based on the average retail price of the product at the terminal.

If there is any omission, please correct

it.

com is: urban public hospitals and county-level public hospitals, urban community centers and township health centers, urban physical pharmacies and online pharmacies, excluding private hospitals, private clinics, village clinics, excluding county and rural pharmacies; The above sales are calculated

based on the average retail price of the product at the terminal.

If there is any omission, please correct

it.