-

Categories

-

Pharmaceutical Intermediates

-

Active Pharmaceutical Ingredients

-

Food Additives

- Industrial Coatings

- Agrochemicals

- Dyes and Pigments

- Surfactant

- Flavors and Fragrances

- Chemical Reagents

- Catalyst and Auxiliary

- Natural Products

- Inorganic Chemistry

-

Organic Chemistry

-

Biochemical Engineering

- Analytical Chemistry

-

Cosmetic Ingredient

- Water Treatment Chemical

-

Pharmaceutical Intermediates

Promotion

ECHEMI Mall

Wholesale

Weekly Price

Exhibition

News

-

Trade Service

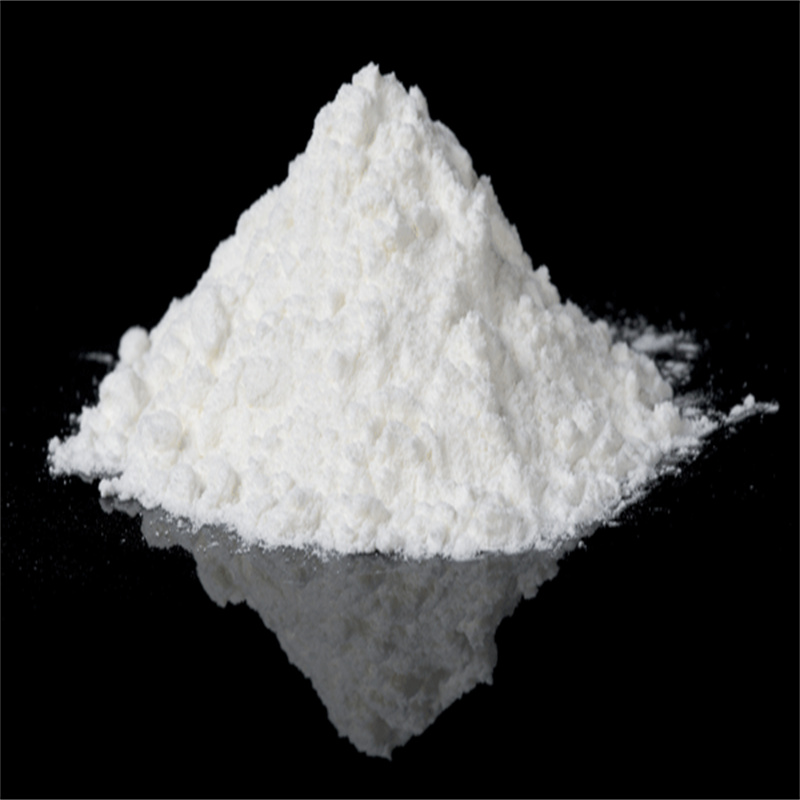

Influenced by the change of supply and demand relationship, in recent years, the global titanium dioxide market often has a big ups and downs phenomenon, the price surge and plunge has become the norm. However, some titanium dioxide giants are not willing to do so,

is trying to break this cycle by establishing price and profit stability mechanisms, structurally changing the industry to mitigate the impact of price crashes and skyrockets on the industry.

giants are testing water

the first to eat crabs was the world's largest producer of titanium dioxide,

China

. The company aims to provide customers with stable prices and a safe supply through its

Value Stability (VS) program for

-branded titanium dioxide products.

two major measures to stabilize the value of the titanium dioxide products of the Company's Yantai brand. The first step is to

guaranteed value agreement (AVA) contract with the customer. Contract prices are adjusted every six months based on the Global Producer Price Index (PPI).

Vergnano, chief executive of Como, said the PPI-based price adjustment mechanism made any price movement more transparent. At the same time, under the AVA contract, customers have the flexibility to obtain titanium dioxide products according to actual demand, without having to strictly enforce the quantity specified in the contract. The company aims to sell more than half of its total titanium dioxide under the AVA contract.

second measure is

flexible supply. Customers can purchase titanium dioxide at a fixed price without signing the contract, provided that the company has an excess supply of the

. Flexible Supply is scheduled to launch in the UK and Brazil in February and will be rolled out globally on 1 March.

is not the only producer of titanium dioxide seeking to introduce such a stabilization mechanism.

and Ventor Materials are also pushing ahead with plans to enter into long-term stable contracts with

. In November 2018, Teno CHIEF Executive Officer Jeff Quinn said Teno was working with customers to stabilize earnings and

sto curb the volatility of earnings in the boom and bust cycles of the industry

. However, progress on earnings stabilization has been delayed by regulatory resistance to Mr. Terno's acquisition of Mr. Coster. John Romano, Chief Commercial Officer of Tyno, said the company aims to sign a profit-stabilizing contract this year that will account for about half of its total sales.

, the world's largest producer of titanium dioxide, is also pushing for long-term stable contracts with customers. Simon Turner, chief executive, said the company was providing customers with a more stable and certain business environment, but was concentrated in Europe.

market share is key

whether the titanium dioxide giant's attempts are successful seems to depend on how many giants try to build a stable supply system. Market participants said that

success of any price or earnings stabilization measures will depend on whether the relevant producers have a certain critical market share

. It is not clear what percentage of the market share of the participating price-stable titanium dioxide producers will need to be combined to have a real impact, but it is clear that the higher the market share, the better.

estimates that the global market demand for titanium dioxide in 2018 will be about 5.9 million tons, of which 60% will be high-end titanium dioxide. At the same time, the global titanium dioxide design capacity is estimated at about 7.5 million tons/year. Como's titanium dioxide production capacity is approximately 1.5 million tons/year, accounting for 20% of the global production capacity, and a higher proportion of the global high-end titanium dioxide market. The rest of the giants include Coster, Venator Materials, Connors, Teno, and China's Dragon Lynx.

to break the cycle of price fluctuations in titanium dioxide is to find enough producers with enough market share to persuade enough customers to sign price-stabilizing contracts.

these companies may need to join in. If such contracts become the norm, perhaps the overall price of titanium dioxide will not rise or fall as much as it has in the past.

challenges are still

not all market participants are optimistic about the efforts of the titanium dioxide giant. Some in the market see this price-alliance-like approach as vulnerable. In a market of rising prices and tight supply, price stability and supply guarantees are attractive. But in an oversupplied market, customers don't want to lock in prices.

a North American titanium dioxide buyer has expressed doubts about Como's VS plan. "The VS program just opens the door for Asian titanium dioxide producers," the buyer said. If the U.S.-China trade war is suspended, U.S. tariffs on Chinese titanium dioxide will be lowered, which will lead to a flood of titanium dioxide from Asia into the North American market. And a trade deal between the U.S. and China is highly likely. The

to break the cycle of extreme price volatility is daunting. Manufacturers are brave enough to try to smooth the price cycle and eliminate fluctuations in the titanium dioxide market. But because they are fighting market forces, the efforts of titanium dioxide companies may not bring the expected benefits

.