On August 10, Huaan Securities and Sinolink Securities gave Huadong Medicine a buy rating

.

China Gold Securities stated in the research report that it is optimistic about the steady development of East China's pharmaceutical industry and circulation business, and the vigorous growth of medical beauty business

.

It is expected that the company will achieve net profit of 2.

90 billion yuan, 3.

35 billion yuan, and 3.

82 billion yuan in 22-24 years, a year-on-year increase of 26%, 15%, and 14%

.

Maintain "Buy" rating

.

Huaan Securities said that the domestic medical beauty market is booming, the industry scale is growing rapidly, and the products are rich and diverse, and are constantly being upgraded

.

Huadong Medicine focuses on light medical beauty, with hyaluronic acid, botulinum toxin, optoelectronic equipment and other products in the layout, and Yiyanshi, the heavyweight product of medical beauty 2.

0, is gradually ushering in a large volume, and there are many follow-up product pipelines, and the future sustainable growth momentum will be strong

.

It is estimated that the company's EPS from 2022 to 2024 will be 1.

44/1.

59/1.

77 yuan/share respectively, corresponding to the current share price PE of 30/28/25 times, respectively

.

Maintain "Buy" rating

.

It is reported that on August 9, Huadong Medicine released its performance report for the first half of 2022.

The report shows that in the first half of this year, Huadong Medicine’s operating income increased by 6% year-on-year to 18.

2 billion yuan; net profit attributable to the parent increased by 3.

1% year-on-year to 13.

4 billion yuan.

The net profit after deducting non-return to the parent company increased by 6.

5% year-on-year to 1.

27 billion yuan

.

If calculated according to the same caliber of the previous year's report excluding the holding subsidiary East China Ningbo, the operating income in the first half of the year increased by 9.

6% year-on-year, and the net profit after deducting non-return to the parent increased by 8.

5% year-on-year

.

Among them, the medical beauty business of Huadong Medicine maintains rapid growth, and the product matrix is expected to continue to enrich

.

In the first half of the year, the company's pharmaceutical business achieved revenue of 897 million yuan (excluding internal offsetting factors), a year-on-year increase of 130% on a comparable basis (excluding Ningbo in East China)

.

From January to June in China, Xin Keli Aesthetics achieved a revenue of 271 million yuan

.

Huaan Securities stated in the research report that since May 2022, Xin Keli Aesthetics' business has shown a recovery and upward trend month by month, and it is optimistic about the sales volume in the second half of the year

.

Sinolink Securities stated in the research report that the official listing of Huadong Medicine's optoelectronic medical beauty device "Ku Xue" is expected to drive the improvement of annual performance

.

In the follow-up, with the continuous approval of products under research, the medical beauty sector is expected to continue to increase volume

.

It is understood that in the process of development, Huadong Medicine's R&D investment has achieved rapid growth.

Data shows that in the first half of this year, the company's R&D expenses increased by 29.

49% year-on-year, reaching 567 million yuan

.

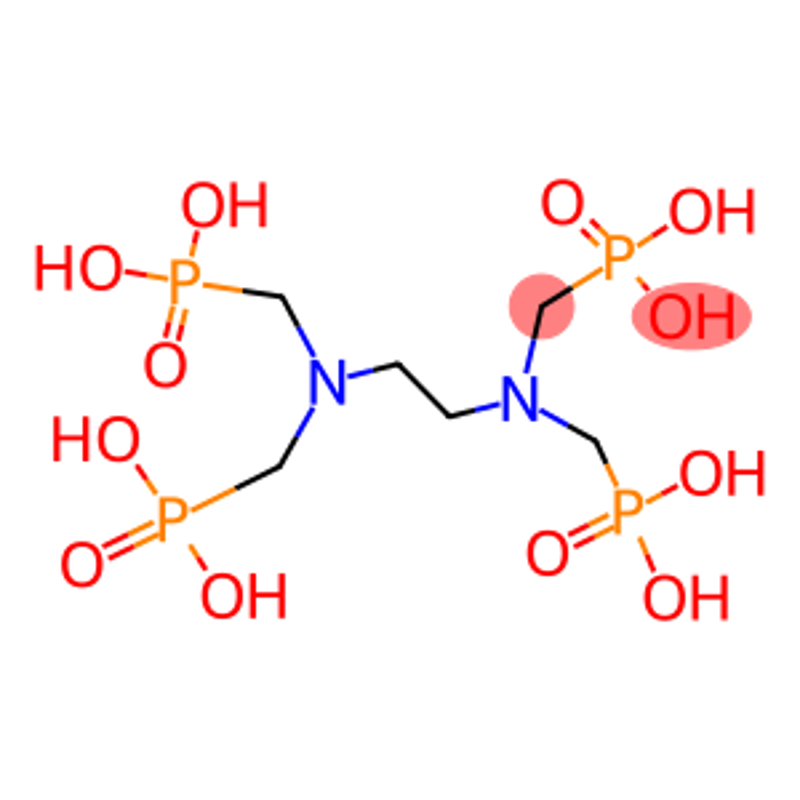

Huaan Securities stated in the research report that Huadong Medicine has continuously developed and formed a differentiated innovative product pipeline covering the entire R&D cycle through independent research and development, external cooperation and product license-in.

There are 43 drug and biosimilar projects, of which 4 products are in Phase III clinical stage and 4 products are in Phase II clinical stage, covering the fields of tumor, endocrine and autoimmunity

.

Sinolink Securities said that the company's blockbuster product liraglutide is about to be approved, and it is expected to achieve commercial sales and drive continuous improvement in performance; the layout of innovative drugs is gradually emerging, and it is expected that more varieties will be listed one after another, driving the company's long-term development

.

In addition, the company's industrial microbiology sector continued to maintain a good development trend, with a year-on-year increase of 31% in the semi-annual report.

Maggie Health, Meihua Hi-Tech, and Huida Biology will gradually be put into production, driving continuous growth in performance

.

In addition to the above two institutions giving Huadong Medicine a buy rating, according to statistics, a total of 11 institutions have rated Huadong Medicine in the past 90 days, 10 have a buy rating and 1 have an overweight rating

.