-

Categories

-

Pharmaceutical Intermediates

-

Active Pharmaceutical Ingredients

-

Food Additives

- Industrial Coatings

- Agrochemicals

- Dyes and Pigments

- Surfactant

- Flavors and Fragrances

- Chemical Reagents

- Catalyst and Auxiliary

- Natural Products

- Inorganic Chemistry

-

Organic Chemistry

-

Biochemical Engineering

- Analytical Chemistry

-

Cosmetic Ingredient

- Water Treatment Chemical

-

Pharmaceutical Intermediates

Promotion

ECHEMI Mall

Wholesale

Weekly Price

Exhibition

News

-

Trade Service

A few days ago, Guangzhou Baiyunshan Pharmaceutical Group Co.

, Ltd.

(hereinafter referred to as "Guangzhou Baiyunshan") announced its 2021 financial report, of which the revenue of the Great Southern Medicine segment was 10.

789 billion yuan, and the top varieties of sildenafil and cefixime were still stable.

leading position

.

In terms of new drug research and development, the two Class 1 new drugs declared by Guangzhou Baiyunshan are in the early clinical stage, and the co-developed ginkgolide B has entered the clinical phase III, which is expected to break the monopoly situation in the future.

.

.

Rapid growth, sildenafil is firmly in the domestic leader With the gradual easing of the domestic new crown epidemic, market demand has rebounded, and Guangzhou Baiyunshan's revenue and profit have both increased

.

In 2021, the company will achieve operating income of 69.

014 billion yuan, a year-on-year increase of 11.

90%; total profit will be 4.

723 billion yuan, a year-on-year increase of 26.

32%

.

Guangyao Baiyunshan's revenue consists of four business segments: "Great Southern Medicine", "Great Health", "Great Business" and "Great Medical Care", of which the Great Southern Medicine segment is the pharmaceutical manufacturing business.

A year-on-year increase of 5.

78%

.

From the perspective of subdivisions, the annual revenue of the two major segments of Chinese patent medicine and chemical medicine is 5.

27 billion yuan and 5.

52 billion yuan respectively

.

From the perspective of subdivided products, the sales revenue of Sildenafil Citrate Tablets, Zishen Yutai Pills, Xiao Chai Hu Granules, Amoxicillin Series, Po Chai Series, Cefuroxime Sodium for Injection, Huatuo Zaizao Pills and other products Both achieved double-digit growth

.

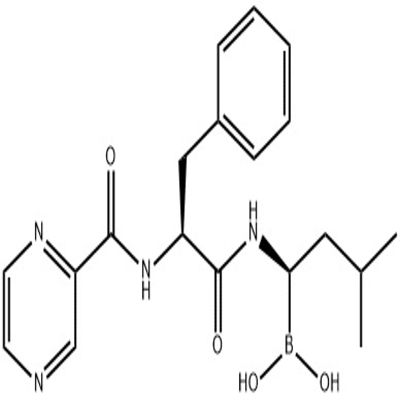

Among them, Sildenafil Citrate Tablets are the largest sales variety of Guangzhou Baiyunshan Da Nan Medicine segment, with annual revenue of 988 million yuan in 2021

.

Pfizer's sildenafil citrate was approved for marketing in China in 2000, and its patent in China expired in 2014, and Guangzhou Baiyunshan successfully won the first imitation

.

Driven by the advantages of both dosage form and price, the market share of Sildenafil Citrate from Guangzhou Baiyunshan has continued to increase after its launch, surpassing that of Pfizer's original research drug in recent years.

.

According to the data of Minet.

com, in the competition pattern of sildenafil citrate manufacturers in China's urban physical pharmacy terminal in 2019, the sales of Guangzhou Baiyunshan surpassed that of Pfizer, and has since ranked first with a share of more than 50%

.

Source of operating data of main medicines (products) of GPHL: Cefixime series is the second largest variety of GPHL in GPHL, with annual revenue of 915 million yuan, but it is subject to the national anti-resistance policy and centralized procurement, etc.

Due to the influence of factors, the sales of some of the company's cephalosporin products showed a downward trend

.

According to the financial report, the revenue of Guangzhou Baiyunshan Cefixime series decreased by 1.

07% year-on-year, and the revenue of cefathiamidine for injection decreased by 44.

21% year-on-year

.

Self-research and cooperation are equally important, and 5 new category 1 drugs are on the way.

As a global top 500 domestic traditional pharmaceutical company, GPHL has also continued to promote the layout of innovative drugs, increasing R&D investment year by year

.

The financial report shows that in 2021, the research and development expenses of Guangzhou Baiyunshan will be 875 million yuan, a year-on-year increase of 42.

94%

.

The industry has revealed that GPHL has more than 10 Category 1 new drug projects under development, covering cardiovascular and cerebrovascular, anti-tumor drugs, vaccines and other fields

.

In the new drug research and development model, Guangzhou Baiyunshan insists on "self-research + cooperation" walking on two legs

.

According to the data from Minet.

com, Guangzhou Pharmaceutical Baiyunshan has applied for 2 new Class 1 drugs, among which cefotaxime sodium has entered the clinical phase I, and BYS10 tablets have been approved for clinical use

.

Source of some original researched new drugs of GPHL: MED2.

0 China Drug Evaluation Database BYS10 is a selective RET small molecule inhibitor developed by GPHL, with indications for advanced stages such as non-small cell lung cancer and medullary thyroid cancer solid tumors

.

According to the global new drug research and development data of Minei.

com, 11 new RET inhibitor drugs have been approved for marketing, but they are mainly multi-target drugs, including lenvatinib, sorafenib, vandetanib, and sunitinib.

Ni et al.

, only serpatinib and pratinib are single-target specific RET inhibitors

.

In 2021, Eli Lilly's global sales of serpatinib will reach 115 million US dollars (about 730 million yuan at the exchange rate on March 29)

.

Cefazamidine sodium is the only new class 1 cephalosporin drug that has successfully obtained clinical approval in China in the past two decades

.

It is worth noting that in recent years, the cephalosporin market has been updated and iterated very quickly.

The first-generation cefathiamidine of Guangzhou Baiyunshan once occupied the top sales list in this category before 2016, but it has been replaced by the third-generation cefoperazone.

Ketosulbactam occupies its place

.

According to data from Minet.

com, in the first half of 2021, the sales volume of terminal cefoperazone-sulbactam in China's urban public hospitals, county-level public hospitals, urban community centers and township health centers (referred to as Chinese public medical institutions) has exceeded 3 billion yuan

.

If cefotaxime sodium can be successfully approved, Guangzhou Baiyunshan is expected to regain the market

.

In addition to self-developed drugs, GPHL has also cooperated with domestic and foreign leading pharmaceutical companies and R&D institutions to develop a variety of Class 1 new drugs

.

Among them, the Chinese medicine injection Ginkgolide B has the fastest progress and has entered the clinical phase III, and HG030 tablets and ketamine have entered the clinical phase

I.

At present, only Ginkgolide injection from Chengdu Baiyu is the only similar drug that has been listed on the market.

The highest sales of this product in public medical institutions in China has exceeded 1 billion yuan

.

If Ginkgolide B is successfully approved for marketing, Guangzhou Baiyunshan will break the market monopoly of Chengdu Baiyu

.

Source of some cooperative research and development of new drugs in GPHL Baiyunshan: Minet.

com global new drug R&D database 19 varieties have been reviewed, and the top varieties are ready for centralized procurement.

Up to now, 19 varieties of GPHL have passed/deemed to pass the consistency evaluation

.

Among them, Sildenafil Citrate and Memantine Hydrochloride Tablets are the first to review

.

GP Baiyunshan Passed/Deemed Passed Consistency Evaluation Varieties Note: The first five batches marked with * are the first to pass the evaluation.

Among the first five batches of centralized procurement carried out in the country, the cefuroxime sodium for injection and cefuroxime axetil tablets of GPHL Baiyunshan, Four varieties of Ciprofloxacin Hydrochloride Tablets and Memantine Hydrochloride Tablets have been selected.

In the upcoming seventh batch of centralized procurement, the top varieties such as Guangzhou Baiyunshan Cefixime series (granules, capsules) have won admission tickets

.

At present, the number of cefixime competitors exceeds 10.

According to Minet.

com data, in the first half of 2021, Guangzhou Baiyunshan, a terminal of public medical institutions in China, has nearly half of the cefixime market share.

If this variety is included in centralized procurement, its existing The top market may face a split

.

Source: Minet database, company financial report Note: The statistics are as of March 29.

If there are any omissions, please correct me!

, Ltd.

(hereinafter referred to as "Guangzhou Baiyunshan") announced its 2021 financial report, of which the revenue of the Great Southern Medicine segment was 10.

789 billion yuan, and the top varieties of sildenafil and cefixime were still stable.

leading position

.

In terms of new drug research and development, the two Class 1 new drugs declared by Guangzhou Baiyunshan are in the early clinical stage, and the co-developed ginkgolide B has entered the clinical phase III, which is expected to break the monopoly situation in the future.

.

.

Rapid growth, sildenafil is firmly in the domestic leader With the gradual easing of the domestic new crown epidemic, market demand has rebounded, and Guangzhou Baiyunshan's revenue and profit have both increased

.

In 2021, the company will achieve operating income of 69.

014 billion yuan, a year-on-year increase of 11.

90%; total profit will be 4.

723 billion yuan, a year-on-year increase of 26.

32%

.

Guangyao Baiyunshan's revenue consists of four business segments: "Great Southern Medicine", "Great Health", "Great Business" and "Great Medical Care", of which the Great Southern Medicine segment is the pharmaceutical manufacturing business.

A year-on-year increase of 5.

78%

.

From the perspective of subdivisions, the annual revenue of the two major segments of Chinese patent medicine and chemical medicine is 5.

27 billion yuan and 5.

52 billion yuan respectively

.

From the perspective of subdivided products, the sales revenue of Sildenafil Citrate Tablets, Zishen Yutai Pills, Xiao Chai Hu Granules, Amoxicillin Series, Po Chai Series, Cefuroxime Sodium for Injection, Huatuo Zaizao Pills and other products Both achieved double-digit growth

.

Among them, Sildenafil Citrate Tablets are the largest sales variety of Guangzhou Baiyunshan Da Nan Medicine segment, with annual revenue of 988 million yuan in 2021

.

Pfizer's sildenafil citrate was approved for marketing in China in 2000, and its patent in China expired in 2014, and Guangzhou Baiyunshan successfully won the first imitation

.

Driven by the advantages of both dosage form and price, the market share of Sildenafil Citrate from Guangzhou Baiyunshan has continued to increase after its launch, surpassing that of Pfizer's original research drug in recent years.

.

According to the data of Minet.

com, in the competition pattern of sildenafil citrate manufacturers in China's urban physical pharmacy terminal in 2019, the sales of Guangzhou Baiyunshan surpassed that of Pfizer, and has since ranked first with a share of more than 50%

.

Source of operating data of main medicines (products) of GPHL: Cefixime series is the second largest variety of GPHL in GPHL, with annual revenue of 915 million yuan, but it is subject to the national anti-resistance policy and centralized procurement, etc.

Due to the influence of factors, the sales of some of the company's cephalosporin products showed a downward trend

.

According to the financial report, the revenue of Guangzhou Baiyunshan Cefixime series decreased by 1.

07% year-on-year, and the revenue of cefathiamidine for injection decreased by 44.

21% year-on-year

.

Self-research and cooperation are equally important, and 5 new category 1 drugs are on the way.

As a global top 500 domestic traditional pharmaceutical company, GPHL has also continued to promote the layout of innovative drugs, increasing R&D investment year by year

.

The financial report shows that in 2021, the research and development expenses of Guangzhou Baiyunshan will be 875 million yuan, a year-on-year increase of 42.

94%

.

The industry has revealed that GPHL has more than 10 Category 1 new drug projects under development, covering cardiovascular and cerebrovascular, anti-tumor drugs, vaccines and other fields

.

In the new drug research and development model, Guangzhou Baiyunshan insists on "self-research + cooperation" walking on two legs

.

According to the data from Minet.

com, Guangzhou Pharmaceutical Baiyunshan has applied for 2 new Class 1 drugs, among which cefotaxime sodium has entered the clinical phase I, and BYS10 tablets have been approved for clinical use

.

Source of some original researched new drugs of GPHL: MED2.

0 China Drug Evaluation Database BYS10 is a selective RET small molecule inhibitor developed by GPHL, with indications for advanced stages such as non-small cell lung cancer and medullary thyroid cancer solid tumors

.

According to the global new drug research and development data of Minei.

com, 11 new RET inhibitor drugs have been approved for marketing, but they are mainly multi-target drugs, including lenvatinib, sorafenib, vandetanib, and sunitinib.

Ni et al.

, only serpatinib and pratinib are single-target specific RET inhibitors

.

In 2021, Eli Lilly's global sales of serpatinib will reach 115 million US dollars (about 730 million yuan at the exchange rate on March 29)

.

Cefazamidine sodium is the only new class 1 cephalosporin drug that has successfully obtained clinical approval in China in the past two decades

.

It is worth noting that in recent years, the cephalosporin market has been updated and iterated very quickly.

The first-generation cefathiamidine of Guangzhou Baiyunshan once occupied the top sales list in this category before 2016, but it has been replaced by the third-generation cefoperazone.

Ketosulbactam occupies its place

.

According to data from Minet.

com, in the first half of 2021, the sales volume of terminal cefoperazone-sulbactam in China's urban public hospitals, county-level public hospitals, urban community centers and township health centers (referred to as Chinese public medical institutions) has exceeded 3 billion yuan

.

If cefotaxime sodium can be successfully approved, Guangzhou Baiyunshan is expected to regain the market

.

In addition to self-developed drugs, GPHL has also cooperated with domestic and foreign leading pharmaceutical companies and R&D institutions to develop a variety of Class 1 new drugs

.

Among them, the Chinese medicine injection Ginkgolide B has the fastest progress and has entered the clinical phase III, and HG030 tablets and ketamine have entered the clinical phase

I.

At present, only Ginkgolide injection from Chengdu Baiyu is the only similar drug that has been listed on the market.

The highest sales of this product in public medical institutions in China has exceeded 1 billion yuan

.

If Ginkgolide B is successfully approved for marketing, Guangzhou Baiyunshan will break the market monopoly of Chengdu Baiyu

.

Source of some cooperative research and development of new drugs in GPHL Baiyunshan: Minet.

com global new drug R&D database 19 varieties have been reviewed, and the top varieties are ready for centralized procurement.

Up to now, 19 varieties of GPHL have passed/deemed to pass the consistency evaluation

.

Among them, Sildenafil Citrate and Memantine Hydrochloride Tablets are the first to review

.

GP Baiyunshan Passed/Deemed Passed Consistency Evaluation Varieties Note: The first five batches marked with * are the first to pass the evaluation.

Among the first five batches of centralized procurement carried out in the country, the cefuroxime sodium for injection and cefuroxime axetil tablets of GPHL Baiyunshan, Four varieties of Ciprofloxacin Hydrochloride Tablets and Memantine Hydrochloride Tablets have been selected.

In the upcoming seventh batch of centralized procurement, the top varieties such as Guangzhou Baiyunshan Cefixime series (granules, capsules) have won admission tickets

.

At present, the number of cefixime competitors exceeds 10.

According to Minet.

com data, in the first half of 2021, Guangzhou Baiyunshan, a terminal of public medical institutions in China, has nearly half of the cefixime market share.

If this variety is included in centralized procurement, its existing The top market may face a split

.

Source: Minet database, company financial report Note: The statistics are as of March 29.

If there are any omissions, please correct me!