-

Categories

-

Pharmaceutical Intermediates

-

Active Pharmaceutical Ingredients

-

Food Additives

- Industrial Coatings

- Agrochemicals

- Dyes and Pigments

- Surfactant

- Flavors and Fragrances

- Chemical Reagents

- Catalyst and Auxiliary

- Natural Products

- Inorganic Chemistry

-

Organic Chemistry

-

Biochemical Engineering

- Analytical Chemistry

-

Cosmetic Ingredient

- Water Treatment Chemical

-

Pharmaceutical Intermediates

Promotion

ECHEMI Mall

Wholesale

Weekly Price

Exhibition

News

-

Trade Service

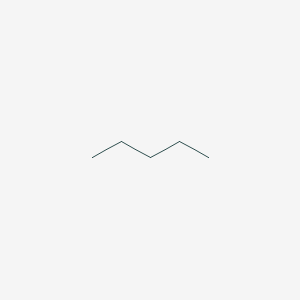

In the last cycle, the decline in the domestic market for butanol once accelerated.

In particular, as the oversupply situation of n-butanol continues to increase, the market decline has become even more rapid, with manufacturers' poor shipments, rising inventories, and high pressure on profit margins.

Appeared

.

The start-up of manufacturers has increased across the board.

All domestic butanol plants are operating stably, and the start-up load has increased.

The main reason is that the maintenance has been completed before September, and the production profit margin is abundant, and it has been at a high level for many years.

Therefore, the manufacturers have increased their horsepower.

Production and even overloaded operations have caused oversupply to continue to intensify.

From September to October, the domestic butanol market has accelerated and continued to decline, and the industry's profitability has rapidly declined, and it is gradually approaching the cost line

.

Until November, as the downstream product market sentiment rebounded, the factory's periodic replenishment demand gradually showed an increasing trend, but octanol manufacturers' willingness to stabilize prices gradually became stronger after their profits continued to suffer; since then, the catalysts were replaced with Chengzhi installations.

, Wanhua and Bohua plants successively stopped production unplanned, and the Hualu plant was also reduced due to the replacement of catalysts, and the operating load of major manufacturers was reduced, and the overall output fell in November

.

Due to various factors, inventory pressure has been quickly eased.

Downstream and some middlemen have seen concentrated bottom-hunting actions.

Manufacturers’ inventories have fallen rapidly.

The market has rebounded after mid-November.

Up to now, the increase has been broadened in line with the enlargement of transactions

.

The operating rate dropped sharply in November.

Manufacturers such as Wanhua, Chengzhi, Bohua and Hualu reduced production due to shutdowns for maintenance or replacement of catalysts, resulting in a reduction in the overall supply in November, and the average operating level decreased by more than 10% compared with the previous month.

In the past half month, with Bohua’s unexpected shutdown, market speculation has become stronger, and manufacturers’ low-priced sources of supply have once been sold out.

In addition to the increase in orders received during the replenishment cycle of downstream factories, some middlemen have also made bottom-hunting actions, resulting in manufacturers’ inventory.

Gradually tightened, quotations gradually adjusted back, and the rate of increase continued to expand

.

At the end of the month, the production of Formosa Plastics’ Nanya octanol plant was shut down unexpectedly, which led to the extension of the maintenance plan.

According to statistics, the total domestic imports of Nanya octanol from April to September this year amounted to more than 10,000 tons, maintaining at the level of 1-2 ships per month.

Although the proportion is relatively small, the strong growth phase of the octanol market is superimposed, and the market growth rate immediately expands, and the n-butanol market is simultaneously following up and regaining the upward trend.

.

So far, the cumulative increase of butanol has reached more than 500 yuan/ton.

Propylene has been showing a trend of callback under the weakening of supply and demand.

The cost has been temporarily shelved in the face of the impact of butanol, but the profit margin has been expanded again

.

The downstream DOP market of octanol also performed strongly this month.

In the initial stage, the phthalic anhydride surge supported the first to pull up.

Therefore, with the expansion of the octanol growth rate, based on the actual shrinking trend of the plasticizer industry demand, the DOP factory cost transmission showed signs of weakening.

And this month, the actual overall situation has always been on the verge of loss.

Therefore, octanol has once again suppressed DOP.

The uneven state of upstream and downstream profit levels has become obvious.

The market outlook is expected that the factory will resist the high level of octanol

.

However, the downstream market of n-butanol butyl acrylate once showed a strong rise in the second half of this month.

The factory's production enthusiasm has increased, and the purchase of n-butanol has increased, but the increase is limited.

After December, it is also expected to have an increase in the purchase of raw materials.

Decrease trend

.

Therefore, Zhongyu Information believes that the butanol market’s upward trend has been "declining and exhausted".

In the short term, the butanol market is showing a trend of convergence, and as time goes on, the market may enter a callback phase next month.

In particular, as the oversupply situation of n-butanol continues to increase, the market decline has become even more rapid, with manufacturers' poor shipments, rising inventories, and high pressure on profit margins.

Appeared

.

The start-up of manufacturers has increased across the board.

All domestic butanol plants are operating stably, and the start-up load has increased.

The main reason is that the maintenance has been completed before September, and the production profit margin is abundant, and it has been at a high level for many years.

Therefore, the manufacturers have increased their horsepower.

Production and even overloaded operations have caused oversupply to continue to intensify.

From September to October, the domestic butanol market has accelerated and continued to decline, and the industry's profitability has rapidly declined, and it is gradually approaching the cost line

.

Until November, as the downstream product market sentiment rebounded, the factory's periodic replenishment demand gradually showed an increasing trend, but octanol manufacturers' willingness to stabilize prices gradually became stronger after their profits continued to suffer; since then, the catalysts were replaced with Chengzhi installations.

, Wanhua and Bohua plants successively stopped production unplanned, and the Hualu plant was also reduced due to the replacement of catalysts, and the operating load of major manufacturers was reduced, and the overall output fell in November

.

Due to various factors, inventory pressure has been quickly eased.

Downstream and some middlemen have seen concentrated bottom-hunting actions.

Manufacturers’ inventories have fallen rapidly.

The market has rebounded after mid-November.

Up to now, the increase has been broadened in line with the enlargement of transactions

.

The operating rate dropped sharply in November.

Manufacturers such as Wanhua, Chengzhi, Bohua and Hualu reduced production due to shutdowns for maintenance or replacement of catalysts, resulting in a reduction in the overall supply in November, and the average operating level decreased by more than 10% compared with the previous month.

In the past half month, with Bohua’s unexpected shutdown, market speculation has become stronger, and manufacturers’ low-priced sources of supply have once been sold out.

In addition to the increase in orders received during the replenishment cycle of downstream factories, some middlemen have also made bottom-hunting actions, resulting in manufacturers’ inventory.

Gradually tightened, quotations gradually adjusted back, and the rate of increase continued to expand

.

At the end of the month, the production of Formosa Plastics’ Nanya octanol plant was shut down unexpectedly, which led to the extension of the maintenance plan.

According to statistics, the total domestic imports of Nanya octanol from April to September this year amounted to more than 10,000 tons, maintaining at the level of 1-2 ships per month.

Although the proportion is relatively small, the strong growth phase of the octanol market is superimposed, and the market growth rate immediately expands, and the n-butanol market is simultaneously following up and regaining the upward trend.

.

So far, the cumulative increase of butanol has reached more than 500 yuan/ton.

Propylene has been showing a trend of callback under the weakening of supply and demand.

The cost has been temporarily shelved in the face of the impact of butanol, but the profit margin has been expanded again

.

The downstream DOP market of octanol also performed strongly this month.

In the initial stage, the phthalic anhydride surge supported the first to pull up.

Therefore, with the expansion of the octanol growth rate, based on the actual shrinking trend of the plasticizer industry demand, the DOP factory cost transmission showed signs of weakening.

And this month, the actual overall situation has always been on the verge of loss.

Therefore, octanol has once again suppressed DOP.

The uneven state of upstream and downstream profit levels has become obvious.

The market outlook is expected that the factory will resist the high level of octanol

.

However, the downstream market of n-butanol butyl acrylate once showed a strong rise in the second half of this month.

The factory's production enthusiasm has increased, and the purchase of n-butanol has increased, but the increase is limited.

After December, it is also expected to have an increase in the purchase of raw materials.

Decrease trend

.

Therefore, Zhongyu Information believes that the butanol market’s upward trend has been "declining and exhausted".

In the short term, the butanol market is showing a trend of convergence, and as time goes on, the market may enter a callback phase next month.