AbbVie Skyrizi head-to-head Phase III study beats Novaral Cosentyx

-

Last Update: 2021-03-03

-

Source: Internet

-

Author: User

Search more information of high quality chemicals, good prices and reliable suppliers, visit

www.echemi.com

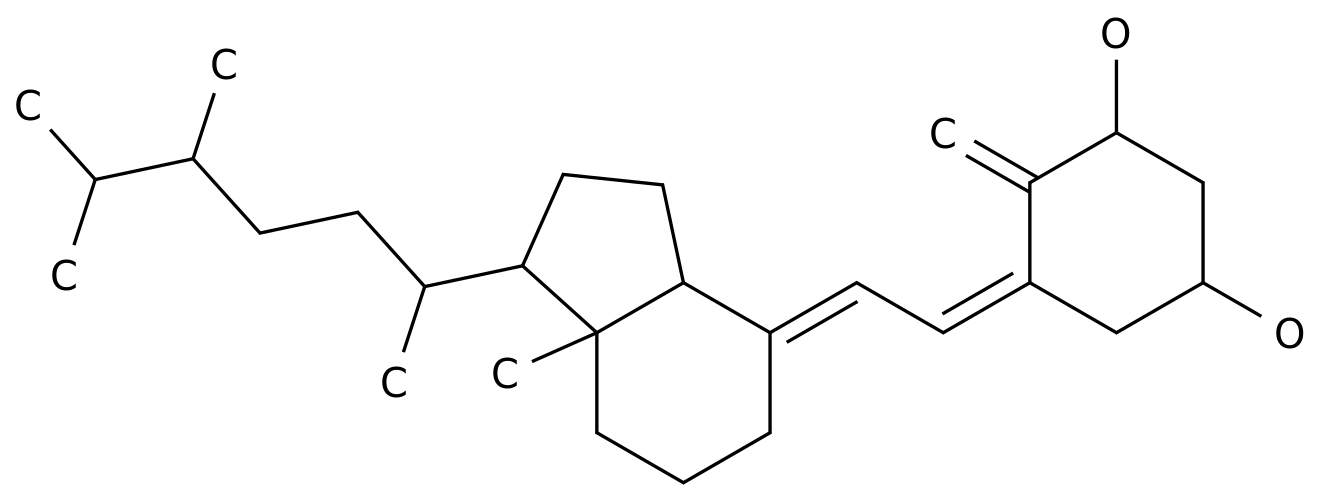

AbbVie recently announced that the head-to-head Phase III study (NCT03478787) to assess Skyrizi and Novartis Cosentyx's treatment of plaque psoriasis (NCT03478787) has reached the primary and secondary end points.This multi-center, randomized, open-label, efficacy evaluator-blind, positive drug-controlled study was conducted in adult patients with moderate to severe plaque psoriasis suitable for systematic treatment, comparing the safety and effectiveness of Skyrizi and Cosentyx. In the study, patients were randomly assigned to receive: (1) Skyrizi (n-164), dose 150 mg (subsoil injection, 2 doses of 75 mg), at baseline, 4 weeks later, after 12 weeks subsulation injection twice 75 mg; (2) Cosentyx (n-163), dose 300mg (subsult injection, 2 doses of 150mg), at baseline, 1 week, 2 weeks, 3 weeks and 4 weeks and thereafter every 4 weeks subsult injections of 150 mg. The study had two main endpoints (PASI90: non-inferiority in week 16, superiority in week 52) and three secondary endpoints (week 52 PASI100, week 52 sPGA 0/1, week 52 PASI75). Conduct safety assessments for all patients.results showed that the Skyrizi group had a significantly higher skin loss removal rate than the Cosentyx group, reaching the primary endpoint of the advantage of PASI90 (psoriasis area and severity index improved by at least 90% over the baseline) in week 52. The data show that the proportion of patients who achieved PASI90 in week 52 of treatment was 87% in the Skyrizi group and 57% in the Cosentyx group (p<0.001). The study also reached the non-inferior primary endpoint of PASI90 in week 16: the proportion of patients who achieved PASI90 in week 16 of treatment was 74 per cent in the Skyrizi group and 66 per cent in the Cosentyx group. In addition, Skyrizi has shown superiority (p<0.001) at all secondary ends (including Week 52 PASI100, PASI75, sPGA 0/1) compared to Cosentyx.security data show that Skyrizi's security is consistent with previously reported findings and no new security signals were observed for 52 weeks. Skyrizi and Cosentyx have comparable rates of adverse events (AEs). The most common AEs are nasopharyngitis, upper respiratory tract infections, headaches, joint pain and diarrhea. The rates of serious adverse events in the Skyrizi and Cosentyx groups were 5.5 per cent and 3.7 per cent, respectively. The rates of adverse events in the Skyrizi and Cosentyx groups that led to drug deactivity were 1.2% and 4.9%, respectively. No patients died in neither treatment group.Dr Michael Severino, Vice Chairman and President of AbbVie, said: "In this study, Skyrizi showed higher results in helping patients achieve and maintain high levels of dertic removal in week 52 than Cosentyx. Head-to-head research data like this is critical to helping patients and their doctors make informed treatment decisions. We are pleased to add these results to the growing body of evidence that supports Skyrizi as a differentiated treatment option for psoriasis patients.Skyrizi's active drug ingredient is risankizumab, a monoclonal antibody drug that selectively blocks the immune inflammatory medium leukocyte interleukin-23 (IL-23), a cytokine that is thought to play a key role in many chronic immune diseases by specifically targeting IL-23p19 sub-base. Risankizumab was originally developed by German drug company Blinger Ingeham (BI), and AbbVie acquired the global commercialization rights to risankizumab in February 2016 with an advance payment of $600 million.2019, Skyrizi was approved in the United States and the European Union for the treatment of adult patients with moderate to severe plaque psoriasis. Currently, Skyrizi's treatment of Crohn's disease and psoriasis arthritis is clinical in Phase III. In addition, AbbVie is evaluating Skyrizi's treatment for other inflammatory and immunological diseases such as ulcerative colitis.Skyrizi is entering a crowded market that will compete with several drugs, including Novarma Cosentyx and Ilaris, Lilly's Taltz, Valeant's Siliq, Johnson and Johnson's Tremfya, Sun Pharmaceuticals' Ilumya and others. Of these drugs, Tremfya and Ilumya are also selectively targeted at IL-23 biotherapy. However, despite all these rivals, the industry remains bullish on Skyrizi's business prospects. Evaluate Pharma, a pharmaceutical market research organization, had previously forecast annual sales of $2.2 billion by 2024.Cosentyx is the first human monoclonal antibody drug specific to target the suppression of white melebin-17A (IL-17A), which selectively targets the activity of cyclic IL-17A, reduces immune system activity and improves disease symptoms. Studies have revealed that IL-17A played an important role in driving the body's immune response to a variety of autoimmune diseases, including psoriasis arthritis (PsA), plaque-type psoriasis (PsO), and strong straight spinal inflammation (AS).Cosentyx was approved for listing in January 2015 and has now been approved for three adaptations (PsO, PsA, AS). Cosentyx has five years of continuous efficacy and safety data on the three major adaptations, with more than 250,000 patients worldwide receiving the drug.in China, Cosentyx ® was approved on April 1, 2019 to treat adult patients with moderate to severe plaque-like psoriasis that conforms to systemic therapy or phototherapy. It is worth mentioning that Cosentyx ® is also the first psoriasis biologic to be approved in the 2018 National Drug Administration's Drug Review Center's List of First Clinically Urgent Overseas New Drugs. On May 20, 2019, Novarma Pharmaceuticals (China) announced that Cosentyx ® has officially started its national supply, bringing new treatment options to patients with moderate to severe psoriasis in China.2018, Cosentyx's global sales reached $2,837 million, up 37% from 2017. Evaluate Pharma, a pharmaceutical market research organization, predicts that Cosentyx will be one of the key products driving Novarma's future growth, with Sales of Cosentyx expected to grow steadily over the next few years as the number of adaptive disorders increases steadily, with global sales expected to reach $5.5 billion in 2024. (Bio Valley Bioon .com)

This article is an English version of an article which is originally in the Chinese language on echemi.com and is provided for information purposes only.

This website makes no representation or warranty of any kind, either expressed or implied, as to the accuracy, completeness ownership or reliability of

the article or any translations thereof. If you have any concerns or complaints relating to the article, please send an email, providing a detailed

description of the concern or complaint, to

service@echemi.com. A staff member will contact you within 5 working days. Once verified, infringing content

will be removed immediately.